For many aspiring homeowners, obtaining a mortgage is a crucial step in the journey towards purchasing a property. The mortgage process can seem daunting at first, with its various steps and requirements, but understanding the process can help simplify it and make it more manageable. Here's a step-by-step guide to the mortgage process:

- Determine Your Budget: Before applying for a mortgage, it's essential to assess your financial situation and determine how much you can afford to borrow. Consider factors such as your income, expenses, debts, credit score, and down payment amount. Use online calculators or consult with a mortgage broker to estimate your maximum loan amount and monthly payments.

- Get Pre-Approved: A pre-approval letter from a lender indicates that you are qualified to borrow a certain amount of money based on your financial profile. Getting pre-approved for a mortgage can give you a competitive edge when making an offer on a property, as sellers are more likely to consider offers from pre-approved buyers.

- Choose a Lender: Shop around and compare mortgage rates, terms, and fees from various lenders to find the best option for your needs. Consider factors such as interest rates, loan types (fixed-rate vs. adjustable-rate), loan terms (15 years vs. 30 years), and closing costs.

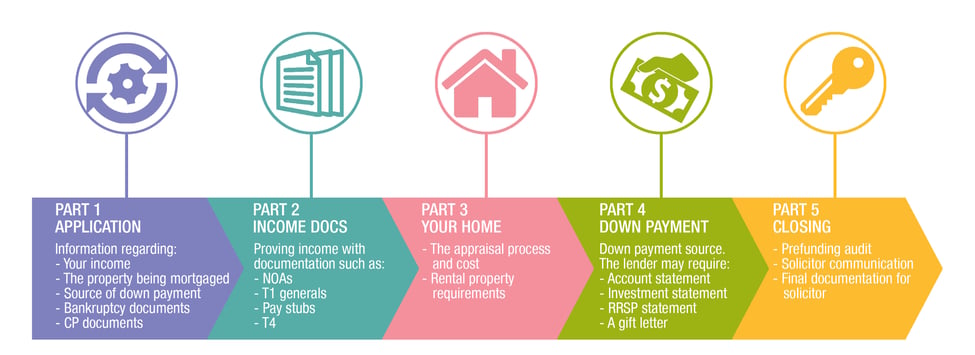

- Submit Your Application: Once you've chosen a lender, you'll need to submit a mortgage application, along with supporting documents such as pay stubs, tax returns, bank statements, and proof of identity. The lender will review your application and documentation to assess your creditworthiness and determine whether to approve your loan.

- Underwriting: After receiving your application, the lender will conduct a thorough review of your financial information, employment history, credit score, and other factors to assess your risk as a borrower. This process, known as underwriting, may involve requesting additional documentation or clarification on certain aspects of your application.

- Appraisal and Home Inspection: As part of the mortgage process, the lender will typically require an appraisal and home inspection to assess the property's value and condition. The appraisal ensures that the property is worth the purchase price and serves as collateral for the loan. The home inspection identifies any potential issues or defects that may affect the property's value or safety.

- Mortgage Approval and Closing: If the underwriter approves your loan and the property meets the lender's requirements, you will receive a mortgage commitment letter outlining the terms and conditions of the loan. The final step in the mortgage process is the closing, where you sign the loan documents, pay closing costs, and take ownership of the property. The lender will fund the loan, and the title will be transferred to you, completing the purchase.

- Repayment: Once you've secured a mortgage and purchased a property, you'll need to make monthly mortgage payments to repay the loan over time. Mortgage payments typically consist of principal and interest, as well as property taxes and homeowners insurance, which may be escrowed and paid along with your mortgage payment.

In conclusion, the mortgage process can be complex and time-consuming, but with careful planning and preparation, you can navigate it successfully and achieve your goal of homeownership. By understanding the steps involved, working with a knowledgeable lender, and staying organized throughout the process, you can secure a mortgage that meets your needs and allows you to purchase the home of your dreams.